what is a tax provision account

They are prepared in accordance with ASC 740. Tax provisions are separately recognized.

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation In 2021 Balance Sheet Accounting Accounting And Finance

A tax provision is an estimated amount a business sets aside to pay for its income taxes.

. Provision for Income Tax refers to the provision which is created by the company on the income earned by it during the period under consideration as per the rate of tax applicable to the. The provision account is included in the liabilities section of the balance sheet either as a current or non-current liability depending on its exact nature. A provision for depreciation account is an improvement over the accounting treatment of depreciation.

When you process the sale or. Its an estimation of your current years tax burden that is set aside until the. Tax provisions are an amount set aside specifically to pay a companys income taxesIn order to calculate the tax amount owing a business needs to adjust its gross income.

A tax provision safeguards your business from paying penalties and interest on late taxes. The amount of this. As it is an estimate of tax liability therefore it is recorded as a provision and not a liability.

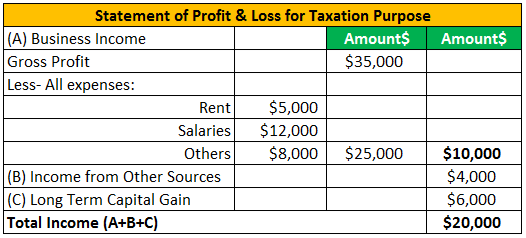

After adjusting necessary items from gross profit eg. The provision of income tax is defined as the estimated amount that a business or an individual taxpayer expects to pay in terms of income taxes in the given year. Provisions in Accounting are an amount set aside to cover a probable future expense or reduction in the value of an asset.

Automate your corporate financial close and save time during the tax provision process. This provision is created from profit. In financial accounting under International Financial Reporting Standards IFRS a provision is an account that records a present liability of an entity.

Depreciation booked in books of accounts and. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. This account is used to accumulate depreciation that is provided.

A corporations or limited liability pass-through entitys income taxLLET account. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. The recording of provisions occurs when a company files an expense in the income statement and consequently records a liability on the balance sheet.

Tax provisioning involves calculating the current and deferred value of tax assets and liabilities. On the other hand say your company calculates. Automate your corporate financial close and save time during the tax provision process.

Similar to accounting provisions tax provisions are an amount set aside to pay for a companys expenses that result from income tax. An income tax provision represents the reporting periods total income tax expense. This is usually estimated by applying a fixed percentage.

This includes federal state local and foreign income taxes. The actual payment of tax can be. Ad Reduce manual entry with our ONESOURCE Tax Provision software for corporations.

The amount of this provision is. VAT Provision- tax becomes due or claimable only when you receive or make the payment. This is below the line entry.

By their very nature. A tax provision is just one type of. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

Ad Reduce manual entry with our ONESOURCE Tax Provision software for corporations. The amount of the said. The recording of the liability in the entitys.

Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. What is a tax provision. The Provision in Accounting Meaning The provision in accounting refers to an amount or obligation set aside by the business for present and future obligations.

When you process the sale or purchase the system needs a holding account to accumulate the. In financial accounting a provision is an account which records a present liability of an entity. An income tax provision is the income tax expense that will be reported on the companies financial statements.

Tds Applicability On Fd Budgeting Investing Income Tax Return

Personal Financial Statements Template Best Of 40 Personal Financial Statement Templates Personal Financial Statement Financial Statement Statement Template

Tax Accounting Meaning Learn Basics Of Tax Accounting

Provision Of A Range Of Accounting Services Required By A Customer Is Also Of Great Significance Whatever Account Business Growth Accounting Services Business

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

And Authority Directed To Unblock The Input Tax Credit Available In The Credit Ledger Account Of Assessee Tax Credits Public Limited Company Author

Tax Accounting Meaning Learn Basics Of Tax Accounting

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank Charges Refund Letter Template 10 Printable Letter Templates Lettering Letter Templates

Once Books Of Account Are Rejected For Want Of Supporting Vouchers And Details Then Income Of Taxpayer Is Required To Be Estimated Rejection Accounting Income

New Tax Provision For Nris Income Tax Online Taxes Tax Services

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Sample Financial Statement Small Business Philippines And Sample Financial Statement For Sm Personal Financial Statement Financial Statement Statement Template

Provision For Income Tax Definition Formula Calculation Examples

Pin By The Taxtalk On Gst Bank Account Success Message Bank

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Financial Statement Worksheet Template Excelguider Com Personal Financial Statement Financial Statement Statement Template